A short straddle is a non-directional options trading strategy that involves simultaneously selling a put and a call of the same underlying security, strike price and expiration date. The profit is limited to the premiums of the put and call, but it is risky if the underlying security's price goes up or down much. The deal breaks even if the intrinsic value of the put or the … [Read more...]

Long Straddle Option Trading Strategy

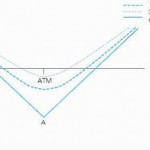

A long straddle involves going long, i.e., purchasing, both a call option and a put option on some stock, interest rate, index or other underlying. The two options are bought at the same strike price and expire at the same time. The owner of a long straddle makes a profit if the underlying price moves a long way from the strike price, either above or below. Thus, an investor … [Read more...]

Put Bear Spread – Option Trading

Bear spread in which a put with a higher striking price is purchased and one with a lower striking price is sold, both options having the same expiration date. This spread is sometimes more broadly categorized as a "vertical spread": a family of spreads involving options of the same stock, same expiration month, but different strike prices. They can be created with either all … [Read more...]

Call Bearspread – Option Trading

A bear call spread is a limited profit, limited risk options trading strategy that can be used when the options trader is moderately bearish on the underlying security. It is entered by buying call options of a certain strike price and selling the same number of call options of lower strike price (in the money) on the same underlying security with the same expiration … [Read more...]

Put BackSpread Option- Explained

Put back spreads are great strategies when you are expecting big downward moves in already volatile stocks. The trade itself involves selling a put at a higher strike and buying a greater number of puts at a lower strike price. The put backspread is a strategy in options trading whereby the options trader writes a number of put options at a higher strike price (often … [Read more...]