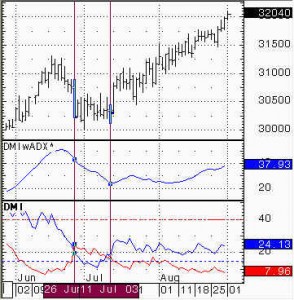

Directional Momentum Index ,DMI.is an indicator used in technical analysis to determine if a financial instrument, such as a stock, is trending in particular direction. It is broken into the positive directional indicator (+DI), negative directional indicator (-DI) and Average Directional Index (ADX). The value of the index can be zero. The higher the value of the DMI, the better the chance that the stock will move.

The DMI Directional Momentum Index is a tool commonly used by traders to distinguish between weak and strong trends. It is extremely popular with individuals who utilize trading strategies based on trend following systems. It can be used to trade a wide variety of assets, including stocks, commodities and currencies. The directional movement index is actually a moving average of the price range and is typically calculated over a 14-day period. The DMI calculation is based on the price range of the asset over a specific period. Then the most recent price is weighed against the previous price range.

Calculation:

1. Calculation of the positive and negative directional movement – DM – +DMj and-DMj

if Highj> Highj-1, +DMj = Highj – Highj-1, differently +DMj = 0

if Lowj < Lowj-1, -DMj = Lowj-1 – Lowj, differently-DMj = 0

Smaller value from +DMj and -DMj is equated to zero. If they are equal, both are equated to zero.

2. Calculation of the true range- TRj

TRj = max (|Lowj – Closej-1 |, |Highj – Closej-1 |, |Highj – Lowj |)

3. Calculation of a positive directional index and the negative directional index – +DIj and -DIj

If TRj = 0, +SDIj = 0, -SDIj = 0,

if TRj 0, +SDIj = +DMj / TRj; -SDIj =-DMj / TRj

Smoothing +SDI and -SDI by exponentional moving average (EMAve), we receive +DIj and -DIj

+DIj = EMAvej (+SDI, N)

-DIj = EMAvej (-SDI, N)

4. Calculation of the directional movement – DXj:

DXj = (| +DIj –DIj | / | +DIj +-DIj |)

The signal generated from the DMI cross, works great in a trending market and poorly in a sideways market. Wilder recommended only using the system when the market was trending. That then gave rise to the Average Directional Index (ADX) and the turning point concept. The ADX must be above both the +DMI and the -DMI, if it then turns, especially from a high value, it is indicating a similar retracement in price against the underlying trend. Remember the ADX is a trend indicator and doesn’t reflect the direction of the trend, just whether the market is trending or not.