A correlation swap is a financial derivative that allows one to speculate on or hedge risks associated with the observed average correlation, of a collection of underlying products, where each product has periodically observable prices, as with a commodity, exchange rate, interest rate, or stock index.

A Correlation Swap is an instrument that allows an investor to take financial exposure on a set of correlations. Correlation swaps appeared in the early 2000’s as a means to hedge the parametric risk exposure of exotic desks to changes in correlation. Exotic derivatives indeed frequently involve multiple assets, and their valuation requires a correlation matrix for input. Unlike volatility, whose implied levels have become observable due to the development of listed option markets, implied correlation coefficients are unobservable, which makes the pricing of correlation swaps a perfect example of ‘chicken-egg problem.’

Pricing and valuation

No industry-standard models yet exist that have stochastic correlation and are arbitrage-free.

Payoff Definition

The fixed leg of a correlation swap pays the notional Ncorr times the agreed strike ρstrike, while the floating leg pays the annualized realized correlation ρrealized . The contract value at expiration from the pay-fixed perspective is therefore

Ncorr(ρrealized − ρstrike)

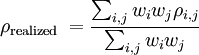

Given a set of nonnegative weights wi on n securities, with observed pairwise correlations measured to be ρi,j the weighted average correlation is defined as