Developed by Marc chaikin, the Chaikin formula attempts to determine if a stock is under accumulation or distribution by comparing the closing price to the high-low range of the trading session. In other words, if the stock closes near the high of the session with increased volume, the CMF increases in value. Alternatively, if the stock closes near the low of the session with increased volume, the CMF decreases in value.

Chaikin Money Flow Formula

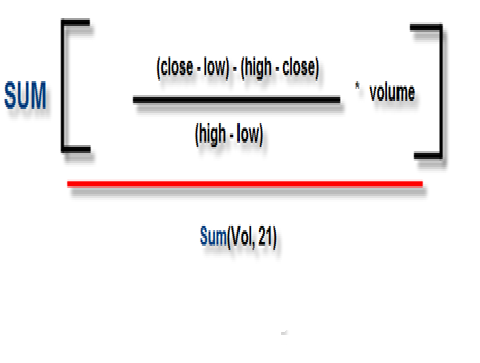

The chaikin money flow indicator is calculated by summing the accumulation/distribution line for “x” periods. Traders generally use 21-periods for calculating the indicator.The formula:

Chaikin Money Flow Formula

The basic trading premise with the CMF indicator is if the indicator is above 0 this is a bullish sign, while a reading below 0 represents a bearish signal. Reading above +.25 or below -.25 indicate strong trends and positions can be added on minor corrections.

Trend Lines

Like many other indicators, traders will draw trend lines on the indicators themselves and look for both breakouts on the indicator and the price on the chart. This method is very subjective, since the trader will have to accurately identify the trend on the indicator.

Divergence

Divergence can show up in the indicator when the chaikin money flow indicator makes a higher high, while the price action makes a lower low. This implies that there is less selling pressure pushing the security lower, thus a bounce is in order.