A collar can be established by holding shares of an underlying stock, purchasing a protective put and writing a covered call on that stock. The option portions of this strategy are referred to as a combination. Generally, the put and the call are both out-of-the-money when this combination is established, and have the same expiration month. Both the buy and the sell sides of … [Read more...]

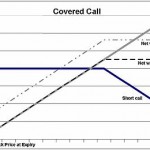

Covered Call- Option Trading

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument, such as shares of a stock or other securities. An options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This … [Read more...]

Put Bull Spread – Option Trading

A type of options strategy that is used when the investor expects a moderate rise in the price of the underlying asset. This strategy is constructed by purchasing one put option while simultaneously selling another put option with a higher strike price. The goal of this strategy is realized when the price of the underlying stays above the higher strike price, which causes the … [Read more...]

Short Put : Option Trading Explained

Writing a put obligates you to buy the underlying stock at the strike price any time until expiry if you are assigned. short put is created when long stock position is combined with a short call of the same series. It is so named because the established position has the same profit potential a short put. Limited Profit Potential The formula for calculating maximum profit … [Read more...]

Long Call Option : Option Trading

The long call option strategy is the most basic option trading strategy whereby the options trader buy call options with the belief that the price of the underlying security will rise significantly beyond the strike price before the option expiration date. Unlimited Profit Potential Since they can be no limit as to how high the stock price can be at expiration date, … [Read more...]