The Short Strangle, is a very similar option trading strategy to a Short Straddle and is the complete reversal of a Long Strangle. Learning the Long Strangle first makes the Short Strangle easier to understand.The Short Strangle strategy is similar to the Short Straddle strategy, except you sell the call option(s) and the put option(s) at different strike prices. When entering … [Read more...]

Long Strangle Option Trading – how to use it

The Long Strangle, or simply the Strangle, is a volatile option trading strategy that profits when the stock goes up or down strongly. The Strangle is a cousin of the Long Straddle and the Long Gut, making up a family of basic volatile options strategies. Learning the Straddle first makes the Strangle easy to understand. The long strangle is simply the simultaneous purchase … [Read more...]

Short Straddle Option Trading Strategy

A short straddle is a non-directional options trading strategy that involves simultaneously selling a put and a call of the same underlying security, strike price and expiration date. The profit is limited to the premiums of the put and call, but it is risky if the underlying security's price goes up or down much. The deal breaks even if the intrinsic value of the put or the … [Read more...]

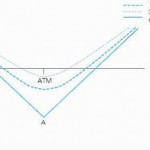

Long Straddle Option Trading Strategy

A long straddle involves going long, i.e., purchasing, both a call option and a put option on some stock, interest rate, index or other underlying. The two options are bought at the same strike price and expire at the same time. The owner of a long straddle makes a profit if the underlying price moves a long way from the strike price, either above or below. Thus, an investor … [Read more...]

Put Bear Spread – Option Trading

Bear spread in which a put with a higher striking price is purchased and one with a lower striking price is sold, both options having the same expiration date. This spread is sometimes more broadly categorized as a "vertical spread": a family of spreads involving options of the same stock, same expiration month, but different strike prices. They can be created with either all … [Read more...]